Unknown Facts About Eb5 Immigrant Investor Program

Table of ContentsEb5 Immigrant Investor Program for DummiesAll About Eb5 Immigrant Investor ProgramThe Only Guide to Eb5 Immigrant Investor ProgramNot known Details About Eb5 Immigrant Investor Program Facts About Eb5 Immigrant Investor Program RevealedWhat Does Eb5 Immigrant Investor Program Mean?

In spite of being less popular, various other paths to getting a Portugal Golden Visa include investments in financial backing or personal equity funds, existing or new business entities, funding transfers, and donations to sustain scientific, technological, artistic and social growths. Owners of a Portuguese resident authorization can likewise work and study in the nation without the demand of acquiring additional authorizations.

The 8-Minute Rule for Eb5 Immigrant Investor Program

Financiers should have both an effective entrepreneurial history and a considerable business record in order to apply. They may include their spouse and their youngsters under 21-years- old on their application for irreversible residence. Effective applicants will get an eco-friendly five-year reentry permit, which allows for open travel in and out of Singapore.

Things about Eb5 Immigrant Investor Program

Applicants can spend $400,000 in federal government authorized real estate that is resalable after 5 years. Or they can spend $200,000 in government accepted actual estate that is resalable after 7 years.

This is the main advantage of immigrating to Switzerland contrasted to various other high tax obligation nations. In order to be qualified for the program, candidates must More than the age of 18 Not be utilized or occupied in Switzerland Not have Swiss citizenship, it should be their first time residing in Switzerland Have actually rented or acquired home in Switzerland Supply a lengthy list of identification files, consisting of tidy rap sheet and excellent ethical personality It takes about after settlement to acquire a resident permit.

Rate 1 visa owners continue to be in standing for about 3 years (depending on where the application was filed) and must use to expand their stay if they want to continue living in the United Kingdom. The Tier 1 (Entrepreneur) Visa is legitimate for three years and four months, with the choice to expand the visa for an additional two years.

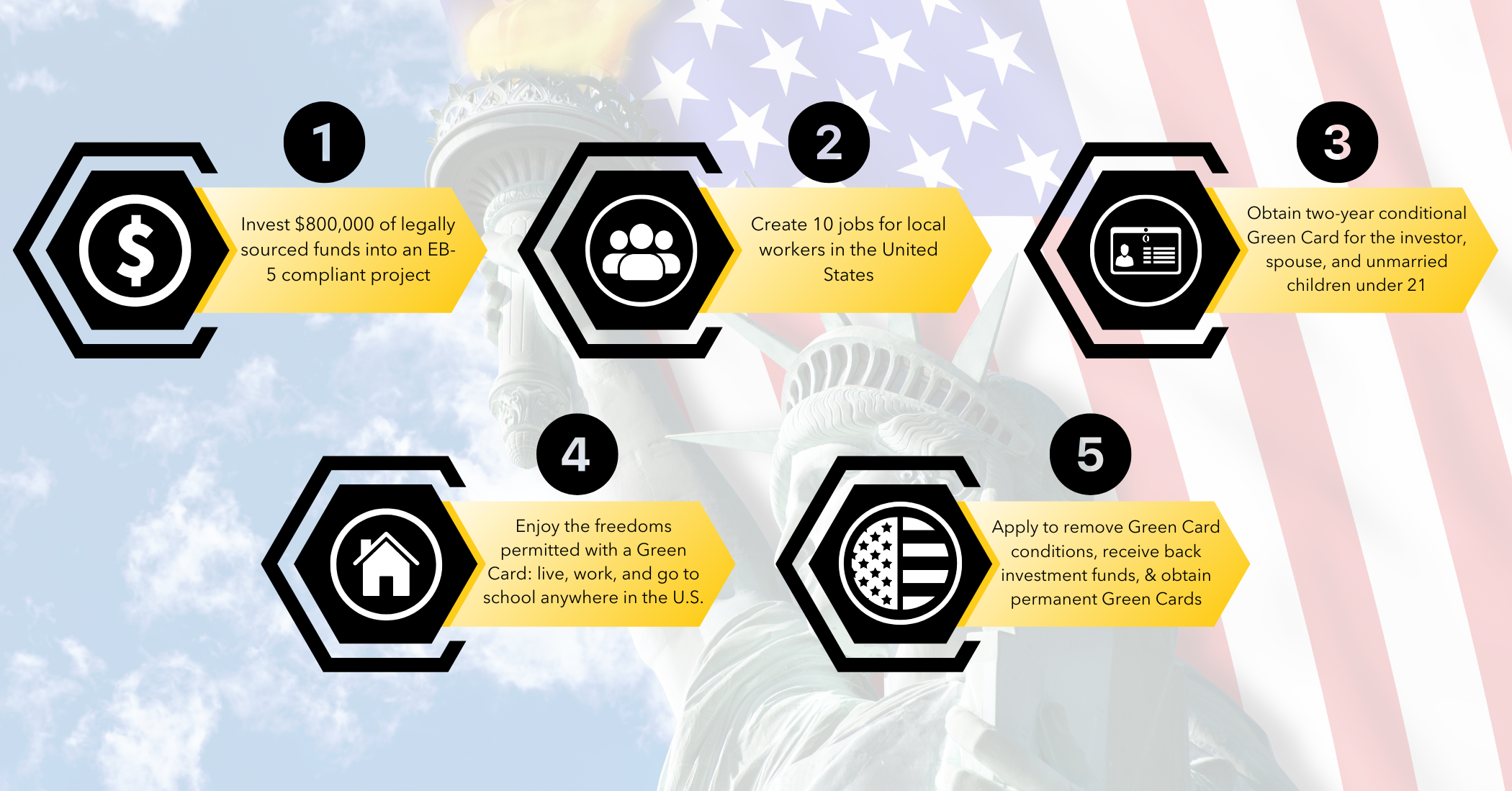

Financial investment immigration has gotten on a this post higher trend for greater than 20 years. The Immigrant Financier Program, additionally referred to as the EB-5 Visa Program, was developed by the united state Congress in 1990 under the Immigration Act of 1990 or IMMACT90. Its primary function: to stimulate the united state economic situation through job production and funding financial investment by international capitalists.

This included minimizing the minimum investment from $1 million to $500,000. Over time, adjustments have boosted the minimal investment to $800,000 in TEAs and $1.05 million in various other locations.

The Definitive Guide to Eb5 Immigrant Investor Program

Visas are "scheduled" each financial year: 20% for rural, 10% for high unemployment, and 2% for framework. Extra books rollover to the following year. Developers in rural areas, high joblessness areas, and facilities projects can gain from a dedicated swimming pool of visas. Investors targeting these particular areas have actually a boosted chance of visa availability.

Developers working with public jobs tasks can currently certify for EB-5 financing. Financiers currently have the possibility to purchase government-backed facilities projects. Certain USCIS interpretations under previous legislation are secured by statute, including banned redemption and financial debt plans, and gifted and lent investment funds. Developers need to ensure their financial investment setups adhere to the brand-new statutory definitions that influence them under U.S.

immigration legislation. EB5 this content Immigrant Investor Program. Financiers must understand the accepted sorts of investment funds and setups. The RIA has developed demands for concerns such as redeployment, unlike before in prior versions of the regulation. Financiers and their families already legally in the U.S. and eligible for a visa number may simultaneously submit applications for modification of standing in addition to or while waiting for adjudication of the financier's I-526 petition.

This simplifies the procedure for financiers already in the U.S., accelerating their capability to readjust status and preventing consular visa processing. Rural jobs obtain Continued concern in USCIS handling. This motivates programmers to initiate projects in backwoods because of the quicker handling times. Financiers searching for a quicker handling time could be more inclined to buy rural tasks.

The Facts About Eb5 Immigrant Investor Program Uncovered

Trying to find U.S. federal government details and solutions?

The EB-5 program is a chance to create work and stimulate the U.S. economic situation. To qualify, candidates should buy brand-new or at-risk companies and develop full time settings for 10 qualifying staff members. The U.S. economic climate benefits most when a location is at threat and the brand-new financier can provide a working facility with full-time tasks.

TEAs were applied right into the capitalist visa program to urge spending in areas with the best need. TEAs can be rural areas or areas that experience high unemployment.

Comments on “Eb5 Immigrant Investor Program - The Facts”